How Much Do Property Managers Charge?

by Gold Coast Property Management

Posted on 31-05-2020 04:39 AM

On This Page

- How Much Do Property Managers Charge?

- Find Property Managers Near You

- Why You Should Consider Income Property as an Investment

- Understanding the Fees and Services of a Property Manager

- Is It Better to Rent from a Landlord or Property Manager?

- 7 Main Responsibilities of a Property Manager

- How Much do Property Managers Charge? Fees, Costs & What to Expect

- Real Estate Asset Management vs Property Management: What to Know

How Much Do Property Managers Charge?

Some property managers charge this fee whenever they have to draw up the paperwork to renew a tenant’s lease. The fee typically ranges from 0-200$. The process doesn’t require a lot of work, so a big fee should be a red flag. You should ask if they require lease renewals or if they allow tenants to go month to month after the initial term is up.

As a baseline, expect to pay a typical residential property management firm between 7 – 10% of the monthly rental value of the property, plus expenses. Some companies may charge, say, $100 per month flat rate. This may or may not be a good deal for you, but most property managers charge the small percent of the monthly rental payment.

Research from ipropertymanagement. Com reveals the typical monthly management fee of Residential property managers in 2019. Read further to learn more about how property managers charge for their services and what red flags to look out for. 7-10% *typical monthly management fee for residential, but can vary greatly by property, location & offering.

The management fee you pay is collected monthly, and it can be a percentage of the rental income or a flat fee. Most property managers will deduct it from the rent before they pay you your rental proceeds. This cost covers the ongoing management of your property. It includes responding to maintenance issues, coordinating with vendors, collecting rent and enforcing the lease. There might be costs that are charged separately from the leasing and management fees. Some companies will charge an additional fee for advertising, inspections, bookkeeping and other functions. Other companies charge only the two fees. Before you sign a management contract, make sure you understand what your fees cover and whether there are other hidden costs.

Many property managers charge a monthly fee for overseeing rent collection, handling maintenance and minor repairs, and communicating with tenants. The monthly management fee for a private residence may be a percentage of the total monthly rent or a flat rate. The monthly percentage fee for commercial property management is lower than that for residential property management at logic property management , explains owner jameson kroll. "a large medical building, for example, may have a monthly rent of $50,000-$60,000, in which case our monthly fee would be 4 percent," says kroll. "however, if the commercial rent is closer to $1,000 per month, our fee would be 10 percent to ensure business costs are met. " here are three examples of average percentage-based monthly fees:.

Most management companies cover everything from lettings to cleaning to answering tenant questions and handling emergency maintenance. The fees they charge are a percentage of the income made by renting out the vacation property. These are the averages found for full-service management across the united states: typical range. The typical range of vacation rental property management fees falls between 15-40%. While it is a wide range, it provides the answer to a commonly asked question for those seeking property management for the first time: how much do property managers charge for vacation rentals?.

On-boarding fee: an on-boarding fee, or setup fee, may be charged as a one time amount to establish a new partnership with management company and set up your account. Setup fees can vary depending on how many properties or units exist in your portfolio.

Every company and their property management fees are obviously different in some ways, but this quick guide should make you aware of what the standards are. Most importantly, as learned by one landlord’s story , be sure to read and agree to all of the rental property management fees and terms. Be sure to look for the small add-on fees and costs that tend to compound like paying for rental signs and advertising material for showing the unit.

No matter what company you hire, your Gold Coast property management fees will include a monthly fee. There are two industry standards when it comes to rental management fees. One is a percentage fee model, so you’ll pay a certain percentage of your rent to the management company. There’s also a flat fee model, which may appear more attractive. However, with a flat fee, you’re often paying a management company even when your property is vacant. So, when you look at the bigger picture, that’s not always in your best interest.

One of the biggest problems i see property management is in setting the correct fees for services provided. Many agents think that fees in management should only be based on passing income or as a flat fee against an ‘industry standard’. That’s the wrong way to do it. The result can and usually is a property management department that is losing money and has no profit coming back for all the hard work put in.

We charge a lease-up fee, which covers the cost of finding you a tenant, marketing your home, and screening applications. Our management fees depend on your property type and volume. For single-family homes, we charge 7 percent of the monthly rent, which is pretty standard in the industry and the local market. If you have a multi-family property or several properties under management with us, we provide a volume discount that can get you as low as 6 percent of the monthly rent per-property. These are our only costs to you, except for maintenance and repairs.

While the leasing fee is charged once, the management fee is charged every month. This is what a landlord pays for the ongoing and professional management of a rental home. The industry standard is pretty similar to what orlando property managers charge. You can expect to pay between eight and 10 percent of your monthly rental income in management fees.

As is the case with any employment scenario, when it comes to hiring a property manager, landlords walk a fine line between ensuring they hire the best help possible and obtaining the most competitive price. Particularly because property management is not a one-size-fits-all kind of field, setting your property management fee at a rate that is both profitable for you and appealing to potential customers can be tricky. While standard property management fees today are set at 10 percent of a unit’s monthly rent rate (and go down to as low as 6 percent), there are a few things you should consider before setting your fee for any given project.

As pointed out above, flat-rate property management companies are more likely to charge extra fees for general maintenance issues that might be covered under a percentage-based model. While owning a new home won’t safeguard you from incurring repair or replacement expenses under either model of management, you’ll probably find a flat-rate management company a lot more likely to “nickel and dime” you for maintenance services a percentage-based firm would treat as standard under the management contract.

Find Property Managers Near You

This is the primary fee you’ll pay each month. This fee covers the day-to-day management of your property, such as collecting and processing rent, communicating with tenants, conducting annual property inspections, coordinating repairs, and responding to emergency maintenance calls. The management fee is usually a percentage of the gross collected rent, but you’ll also find rental property managers who charge a monthly flat fee.

Good Gold Coast Property Managers are skilled at finding and screening tenants quickly and will have a network of reliable, cost-effective repairmen to handle emergencies. Most professional property managers will also understand the landlord-tenant law, thereby reducing the risk of a lawsuit.

One of the main things that property management can assist with is finding, screening , and placing new tenants. Using the guidelines that you provide, property managers will help you to fill vacant lots as quickly and effectively as possible.

For someone starting out as a property investor, finding the right investment property is only half the battle. If you want to ensure that you get the best possible return on the money you spend, it’s essential that you find the right person to manage your investment. From finding tenants and chasing rent to managing any maintenance tasks, property managers perform a long list of important duties. But how much does it cost to hire a property manager and how can you be sure that you’re getting value for money? read on to find out.

The faster you rent your properties, the more money you save. And while it’s easy for landlords to put a sign in the yard or an advertisement in the newspaper to market a rental, it won't get you the kind of marketing traction you need to be effective. Property managers use more effective tactics that lease units faster, find better tenants , and reduce vacancy loss , which saves you money in the long run.

If you feel as though your current property manager isn’t meeting your expectations, there’s no harm in looking at your options. If you’d like to compare property managers or different real estate agencies including marketing fees and property management history, you can compare at localagentfinder. Com. Au, and find the right property manager for your rental property.

Why You Should Consider Income Property as an Investment

Purchasing a property and renting it out to tenants can provide a healthy income stream to willing investors for a very long time. Plus, purchasing investment properties has become easier than ever because of marketplaces like roofstock. But no matter what kind of property you purchase – commercial or residential, single-family or multi-unit – hassles and headaches are inevitable.  Lots of patience and hard work go into finding the right tenants, maintaining the property, and acting responsibly as a landlord.

Lots of patience and hard work go into finding the right tenants, maintaining the property, and acting responsibly as a landlord.

Often, these management fees more than pay for themselves. A los angeles property manager can increase income at your property, and reduce expenses. You also want to take a look at what services are being offered. With a full-service company, you’re getting a lot of hours from a professional who is interacting with your tenants and handling a variety of issues. This is a detail-oriented business with professionals who are taking care of what could be your largest investment.

Enter your investment property information below to view your property management fees for landlord services. The price of our rental management varies on the type and number of rental properties, the total rental income, and the program you choose.

Real estate investment trusts (reits) are corporations that own or finance investment properties. Reits pay 90% of their annual profits in dividends to their investors and have a low tax rate. Profits typically come from rental income and/or interest income. Real estate investment trusts can be either publicly-traded or privately held. Reits give you greater liquidity than owning physical property, and like crowdfunding, have a very low risk investment threshold.

Worried about the cost of hiring a property manager? the fees are worth the peace of mind knowing everything is under control when it comes to your commercial or residential real estate investment. A property manager can also get you more rental income for your property than you may be able to get yourself with extra amenities and an in-depth knowledge of the rental market.

Owning real estate can be a very lucrative investment. Rental properties provide monthly income and value of properties will usually rise most of the time. However for most people the problem is that they often do not have the time to manage these properties on their own. Property management is an excellent solution for “outsourcing” the management of your properties without having to do it yourself. It allows you to have a passive real estate income.

Properties located in desirable locations, like a city’s downtown or ritzy district, may command significantly higher rents. The same factors as above will apply—managers may charge higher percentages for far-flung, low-rent office space so they don’t work just as hard for less income. The location of the commercial office property will affect the management fees in other ways. If you invest in a small office building, and the only commercial property manager you trust is far away, the commercial property manager may charge a higher fee to account for the time spent commuting to and from your investment property.

Understanding the Fees and Services of a Property Manager

One of the most common questions we get asked on a daily basis is what are property management fees.

When you are searching for the right perth property management agency to partner with, you need to have a solid understanding of what fees will be involved. Not all companies are structured the same, so these guidelines may present themselves in other ways like flat-rate services. Make sure you do your research and understand which property services are covered in your contract and if the property management agency uses highly qualified repairmen and agents to handle your property. You don’t want to be overpaying for bad work and careless managers who let your property fall apart.

Is It Better to Rent from a Landlord or Property Manager?

Maintenance fees are generally included as part of the monthly management fee. This could include keeping common areas clean, taking out garbage and snow and leaf removal. If a specific repair must be made, the cost of the repair will be deducted from the reserve repair fund reserve repair fund – this is a separate account that the landlord puts money in for necessary repairs at the property. The landlord can choose to authorize every repair deduction from the account, can choose to only be notified for repairs over a certain dollar amount or can choose to let the property manager use the account at their discretion.

Before setting out to explore the average fee charged for managing real estate premises, it is prudent to establish why you actually need one. When you select a high-quality property manager, he can greatly enhance your premise in the following ways: helping to get high-quality clients if you are a landlord, the last problem you want to encounter is a stubborn client. However, getting good clients is no easy task. Because property managers have been in the job for a long time, consider using them because they know how to vet and get good tenants. These are tenants who pay rent on time, stay longer, co-exist well with others and cause fewer problems.

Property managers essentially save you time and ease the stress and worry that can come with landlording — such as marketing the rental, managing tenants, collecting rent, responding to maintenance requests and handling legal issues. They are often employed by a company that rents your house for you in exchange for a property management fee, which is typically between 7% and 10% of the monthly rent.

Most real estate investors budget between eight and 10 percent of monthly rent for property managers. Biggerpockets forum users report that 10 percent tends to be the norm—and additional fees may cause that number to increase. (looking fora flat fee? unfortunately, flat rates are pretty rare. )before signing on the dotted line, review your financials to make sure hiring a property management company makes sense. Many landlords will find it does, but if you only have one or two properties or your budget is tight, you may want to go it alone.

Generally, you’ll find property managers in burbank use at least one out of the three main categories below to structure their fees. Percentage of monthly rent this is a pretty common way to charge landlords. Property managers charge a percentage of the monthly rent when a landlord employs them on a complete-service basis. The rate can range anywhere between 5-15%. Usually, managers will charge between 8 to 10% for single family homes and 3-10% (discounted) for multi- family units. The discount is dependent upon the size and range of income of the property. This fee structure implies that you do not have to pay if you have not rented your property.

Tenants pay an application fee. There are also late fees charged to the tenant if rent is late, and sometimes the property manager and the landlord will split the late fee that is collected. These fees can be a flat fee, a percentage of the late rent, or a minimal flat fee and then an extra fee every day that the rent is late. A tucson property manager will often charge tenants a communication fee. When the hoa sends out a notice because the weeds are overgrown or the trash cans haven’t been taken in, or someone is parking on the street, property managers incur a cost in communicating with the tenant. It’s usually a nominal fee, but it covers the cost of paperwork and the manager’s time. Eviction fees are also generally the responsibility of a tenant. Each eviction usually comes with processing fees, filing fees, service fees, attorney fees, and other court costs.

Before you decide to self-manage or hire a property manager, you need to understand what goes into managing rental properties. A novice investor may see a rental property as a simple equation of: rental income - (mortgage + expenses) = profit. While this formula is the basic mantra for an investor, you also need to include your landlord duties and energy into that equation. Investors can choose to hire a property management company to handle these duties or self-manage their rental properties. Alternatively, a lot of investors have found success in self-managing their rental properties as a way to cut down on their management expenses.

7 Main Responsibilities of a Property Manager

Which do you trust with your investment? investors, you want to know the difference between property management and asset management before you hire someone in which to entrust your investment. Because there is a difference.  Property management and asset management are two different professions. Property management concentrates on the day-to-day operations of a property. People who work at specific properties are typically fulfilling property management responsibilities. A property manager maintains the value of a property. Property management includes, but is not limited to:.

Property management and asset management are two different professions. Property management concentrates on the day-to-day operations of a property. People who work at specific properties are typically fulfilling property management responsibilities. A property manager maintains the value of a property. Property management includes, but is not limited to:.

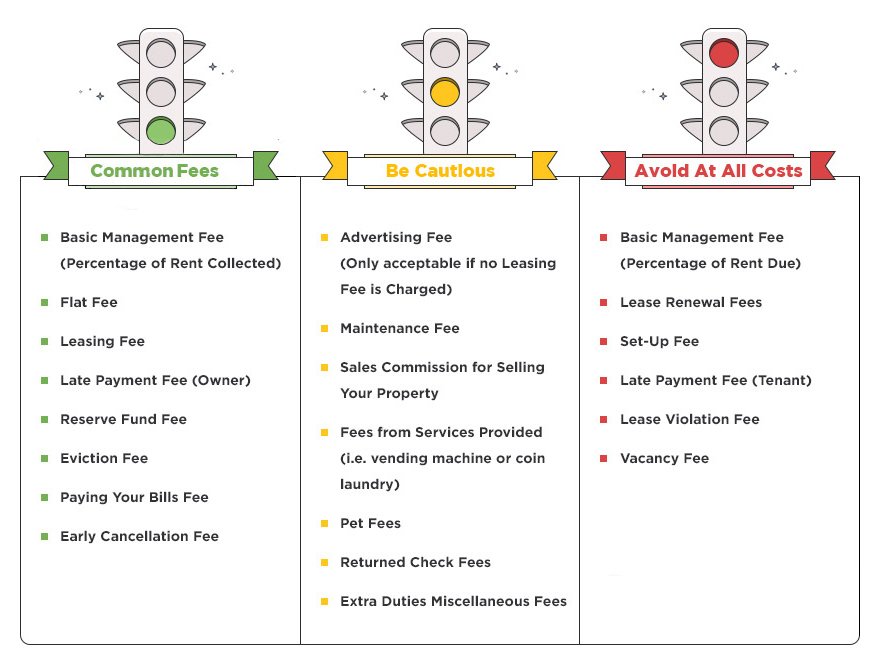

If you are considering moving forward with a property manager, or even if you are already working with one, it is beneficial to research property management company fees. There are a variety of costs that can be included and added on to the responsibilities of property management. Here are some typical property management fees investors can expect to run into:.

There are two different situations when a community may have both property managers and homeowners associations. In the most commonly discussed case, the property management company works for the hoa. In another case, property owners may own some houses or condos in a community that also has owner-occupied units. In this second case, the property owners and their managers are just property owners with the same status as any other owners. If property owners occupy their own housing or lease it to tenants, they still have the same responsibilities to the hoa.

Hiring a property manager doesn't mean you're off the hook with responsibilities, especially if the management company isn't measuring up. Watch for warning signs, like the property is behind on inspection or maintenance work gets overlooked, or you aren't getting a detailed report of your income and expenses related to the property. If you aren't getting a detailed report, ask for one. Are your units are full of less than stellar tenants? asking your property manager how many clients they've had to evict — the number should be low — will give you an idea of their ability to screen new tenants.

If you own a rental property as an investment, chances are you’ll want to hire people to help you rent it out and manage it. Each person you work with has a defined set of responsibilities and a fee for his services. Whether you hire a leasing agent, a property manager or both, ask for a written contract that clearly explains the services you’ll get and the fees you’ll pay.

Use a professional property manager to help you manage your investment properties without all the stress of coping with tenants, turnover and maintenance. Property management insets an extra layer of protection between you and the day to day responsibilities of running you properties. Learn what to expect from your property manager, and what fees you can expect to pay. This can help you manage your budget and your property, worry-free.

Management feed (3-20% of rent roll) accounting responsibilities an individual or company responsible for the day-to-day functioning of a piece of real estate. Resident manager a manager of a property who lives on-site. Management agreement a contract between the owner of a property and someone who agrees to manage it. Property management report an accounting report issued periodically by the property manager to the owner outlining all income and expenditures for that accounting period.

How Much do Property Managers Charge? Fees, Costs & What to Expect

So, what are you paying for an austin property management company to manage your rental property? there are two different structures most austin property management companies like to follow. A common structure is the flat-rate model where you pay a set price in return for their management services. The other common structure to property management companies is a percentage-based model. These companies earn a set percentage of the rent every single month. Both models are very popular among the various property managers austin has, and you’ll want to know what’s included on a per company basis with those costs. While a flat-rate company may seem like a great idea, you’ll want to know exactly what they will and won’t do for your property. Typically, for companies who charge a flat-rate you’ll pay ancillary fees such as trip charges, inspections, serving notices, for monetary reports, etc. The price tag is typically larger per month than what you are expecting. As for the percentage model, while they will typically make more monthly per their fee, they typically won’t have any or near the up-charges a flat-fee manager will. Be wary of any management company that charges regardless of your property being vacant or occupied. Your manager shouldn’t earn if you aren’t.

Real Estate Asset Management vs Property Management: What to Know

It is important to understand the fees associated with the management and marshalling of your investment asset. It is also paramount to understand the educational and professional background of the people who will be caring for your property. If you are fortunate enough to find a property manager who personally owns their own portfolio of properties, who has experienced the real life situations and ups and downs of owning rental property then you are fortunate. Additionally if you find a property management company with trained legal staff, like a real estate attorney for example, that can provide you with even more protection, more risk avoidance strategies, and more personal comfort knowing that the company has more value to their service than most all of the others – then you will be on the right track.

Property management fee means a property management fee for services rendered in connection with the rental, leasing, operation and management of the company’s real estate assets and the supervision of any non-affiliates that are engaged by the manager to provide such services, equal to 4% of the gross rental receipts received each month at the company’s and its subsidiaries’ properties.

How Much Do Property Managers Charge?

Some property managers charge this fee whenever they have to draw up the paperwork to renew a tenant’s lease. The fee typically ranges from 0-200$. The process doesn’t require a lot of work, so a big fee should be a red flag. You should ask if they require lease renewals or if they allow tenants to go month to month after the initial term is up.

As a baseline, expect to pay a typical residential property management firm between 8 – 12% of the monthly rental value of the property, plus expenses. Some companies may charge, say, $100 per month flat rate. This may or may not be a good deal for you, but most property managers charge the small percent of the monthly rental payment.

Research from ipropertymanagement. Com reveals the typical monthly management fee of u. S. Residential property managers in 2019. Read further to learn more about how property managers charge for their services and what red flags to look out for. 8-10% *typical monthly management fee for residential, but can vary greatly by property, location & offering.

The management fee you pay is collected monthly, and it can be a percentage of the rental income or a flat fee. Most property managers will deduct it from the rent before they pay you your rental proceeds. This cost covers the ongoing management of your property. It includes responding to maintenance issues, coordinating with vendors, collecting rent and enforcing the lease. There might be costs that are charged separately from the leasing and management fees. Some companies will charge an additional fee for advertising, inspections, bookkeeping and other functions. Other companies charge only the two fees. Before you sign a management contract, make sure you understand what your fees cover and whether there are other hidden costs.

Many property managers charge a monthly fee for overseeing rent collection, handling maintenance and minor repairs, and communicating with tenants. The monthly management fee for a private residence may be a percentage of the total monthly rent or a flat rate. The monthly percentage fee for commercial property management is lower than that for residential property management at logic property management , explains owner jameson kroll. "a large medical building, for example, may have a monthly rent of $50,000-$60,000, in which case our monthly fee would be 4 percent," says kroll. "however, if the commercial rent is closer to $1,000 per month, our fee would be 10 percent to ensure business costs are met. " here are three examples of average percentage-based monthly fees:.

Most management companies cover everything from booking to cleaning to answering guest questions and handling emergency maintenance. The fees they charge are a percentage of the income made by renting out the vacation property. These are the averages found for full-service management across the united states: typical range. The typical range of vacation rental property management fees falls between 15-40%. While it is a wide range, it provides the answer to a commonly asked question for those seeking property management for the first time: how much do property managers charge for vacation rentals?.

Vacancy fee: some property managers collect a fee even if your rental property is vacant and not making any rental income. Vacancy fees can range from a small flat fee or the regular monthly management fee even if no rent income is coming in. On-boarding fee: an on-boarding fee, or setup fee, may be charged as a one time amount to establish a new partnership with management company and set up your account. Setup fees can vary depending on how many properties or units exist in your portfolio.

every company and their property management fees are obviously different in some ways, but this quick guide should make you aware of what the standards are. Most importantly, as learned by one landlord’s story , be sure to read and agree to all of the rental property management fees and terms. Be sure to look for the small add-on fees and costs that tend to compound like paying for rental signs and advertising material for showing the unit.

No matter what company you hire, your las vegas property management fees will include a monthly fee. There are two industry standards when it comes to rental management fees. One is a percentage fee model, so you’ll pay a certain percentage of your rent to the management company. There’s also a flat fee model, which may appear more attractive. However, with a flat fee, you’re often paying a management company even when your property is vacant. So, when you look at the bigger picture, that’s not always in your best interest.

One of the biggest problems i see in commercial property management is in setting the correct fees for services provided. Many agents think that fees in management should only be based on passing income or as a flat fee against an ‘industry standard’. That’s the wrong way to do it. The result can and usually is a property management department that is losing money and has no profit coming back for all the hard work put in. (nb – you can get plenty of commercial property management fee ideas in ‘snapshot’ right here – it’s free).

At blue frog, we charge a lease-up fee, which covers the cost of finding you a tenant, marketing your home, and screening applications. Our management fees depend on your property type and volume. For single-family homes, we charge 10 percent of the monthly rent, which is pretty standard in the industry and the local market. If you have a multi-family property or several properties under management with us, we provide a volume discount that can get you as low as 6 percent of the monthly rent per-property. These are our only costs to you, except for maintenance and repairs.

While the leasing fee is charged once, the management fee is charged every month. This is what a landlord pays for the ongoing and professional management of a rental home. The industry standard is pretty similar to what orlando property managers charge. You can expect to pay between eight and 10 percent of your monthly rental income in management fees.

As is the case with any employment scenario, when it comes to hiring a property manager, landlords walk a fine line between ensuring they hire the best help possible and obtaining the most competitive price. Particularly because property management is not a one-size-fits-all kind of field, setting your property management fee at a rate that is both profitable for you and appealing to potential customers can be tricky. While standard property management fees today are set at 10 percent of a unit’s monthly rent rate (and go down to as low as 6 percent), there are a few things you should consider before setting your fee for any given project.

As pointed out above, flat-rate property management companies are more likely to charge extra fees for general maintenance issues that might be covered under a percentage-based model. While owning a new home won’t safeguard you from incurring repair or replacement expenses under either model of management, you’ll probably find a flat-rate management company a lot more likely to “nickel and dime” you for maintenance services a percentage-based firm would treat as standard under the management contract.